“We call HazardHub’s data often. When we call them early in the process, it allows us to get a more accurate and more complete acceptability decision on the customer much earlier.”

Sean Harper

CEO/Co-Founder

Enhance the art and science of underwriting with proactive, real-time data. Guidewire analytics, core products, and more are designed to help P&C insurers achieve better underwriting outcomes and improve profitability.

Use analytics to predict risk factors that will degrade loss ratios. Increase straight-through processing rate and capture new business by quoting, declining, and pricing automatically. Underwrite continuously and identify profitable customer segments and new markets to target.

Quote Good Risks Only

2-4%

reduction to loss ratio. Improve your risk selection with Guidewire underwriting.

20%

growth in premium over 4 years. Guidewire underwriting data and analytics help to drive more premium over time.

$50M

improvement in underwriting profit within 36 months, according to customer success metrics.

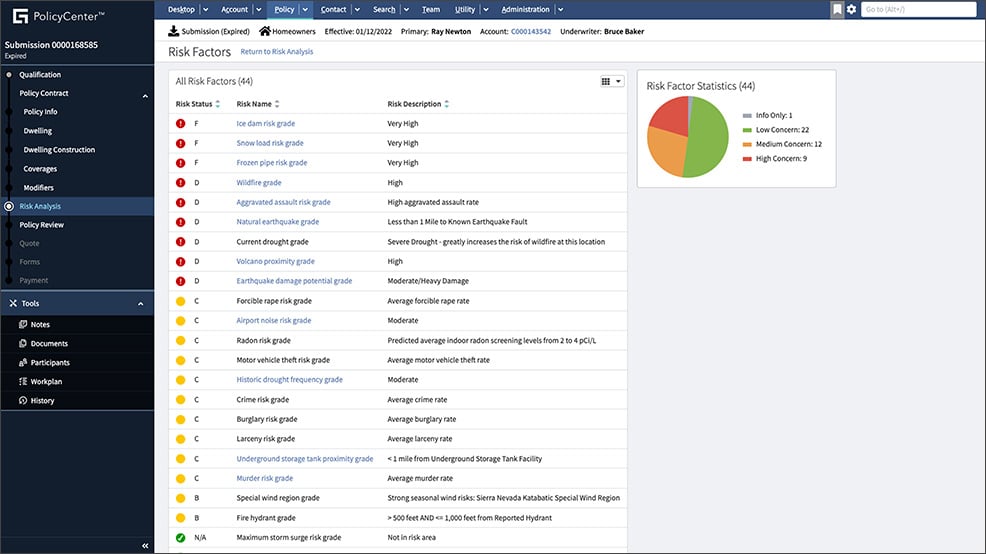

HazardHub provides A-F letter risk grades and numeric risk scores for multiple perils including fire, wind, earth, and manmade disasters. With Predict, P&C insurers have embedded insights to improve intelligent choices, from risk selection to pricing, retention, and reducing expenses.