Manage Workers’ Compensation with Empathy and Clarity

Guidewire's Workers’ Compensation helps insurers manage work-related injuries across claims, medical management, and payments with confidence. It’s designed to support injured workers, enable timely care and return-to-work outcomes, and improve operational efficiency. With Guidewire, you can:

- Streamline workers’ comp claims handling with automated workflows, integrated medical management, and clear visibility into reserves, benefits, and payments

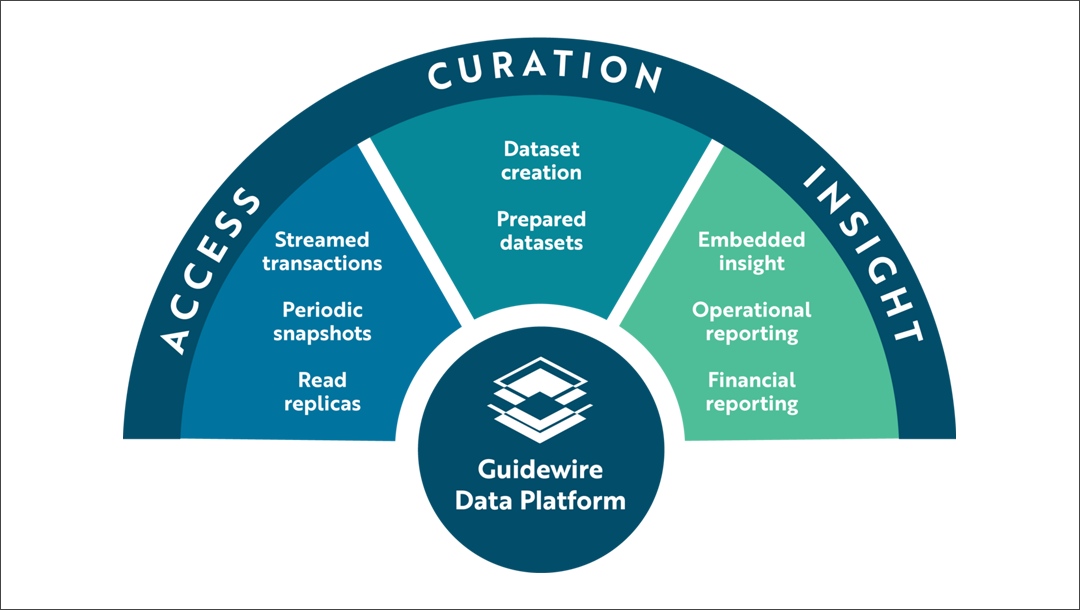

- Gain clearer insight into loss drivers, claim duration, and outcomes using analytics that support better decisions across policy and claims