“HazardHub is the backbone of our data that drives underwriting decision making and pricing within our products.”

Ryan Jesenik

Chief Operating Officer

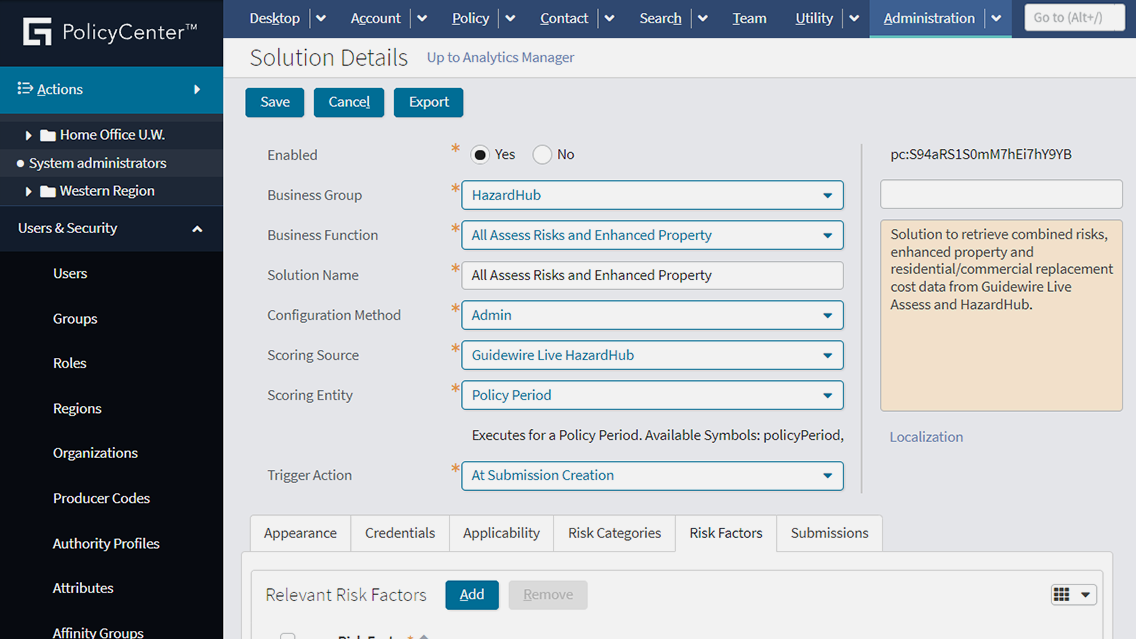

Effortlessly assess property risk data and hazard risk scoring. Use the most comprehensive and accurate hazard risk analytics data to quickly enhance underwriting, optimize pricing, and boost profitability.

Access 1,250+ data points and 50+ peril scores for personal and commercial properties across the United States, Canada, and 19 additional countries, available as a standalone solution or seamlessly integrated into existing core systems from Guidewire, such as InsuranceSuite, or other third-party vendors.

HazardHub allows P&C insurers to underwrite faster and more accurately while improving pricing for personal and commercial property insurance.

Accelerate Workflows

All fields are required

HazardHub data is used throughout the customer journey to improve decision-making.

As the industry’s most comprehensive set of data for hazard risks, HazardHub provides an unrivaled digital toolbox to deliver a comprehensive product experience.