The property and casualty (P&C) insurance industry finds itself navigating a landscape fraught with complexities. Escalating loss frequencies, inflationary pressures, and a constricted reinsurance market have collectively ushered in an environment that demands strategic agility and more innovative responses.

In recent years, the industry has experienced a concerning increase in the frequency and severity of losses due to natural catastrophes. Climate change, declared a 'code red' emergency by the UN, threatens to further exacerbate these challenges. Yet, the hurdles don't end there. The auto insurance sector is also grappling with historically elevated loss ratios, reaching its highest combined ratio in nearly half a century. These trends stand as prime examples of the transformative shifts impacting the industry.

This report delves into these critical imperatives confronting the insurance sector in 2024 and beyond. It explores how the industry plans to address the challenges posed by the climate crisis and adapt to the changing dynamics of the auto insurance market. Additionally, it examines the strategies that may be employed to rebalance risk and extract maximum value from the wealth of data becoming available to insurers.

As we step into 2024, it is clear that the insurance sector and individual insurers must innovate in these areas to drive greater efficiency and resilience.

1. Increased strategic focus on mitigating climate change risks

Laura Drabik, Chief Evangelist, Guidewire “The rate of climate change surged alarmingly” over the past decade, according to a December 2023 report from the World Meteorological Organization (WMO) – which, according to the UN Environment Programme, poses a ‘code red’ emergency for the world. It is also a code red for the insurance industry.

As concerns about the impacts of climate change intensify, insurers are increasingly prioritizing strategies to identify and mitigate related risks.

Insurers can start this journey by rethinking their risk assessment processes. A report by the consulting firm McKinsey recommends that insurers use their annual policy cycle and their understanding of evolving risks to reprice and rearrange portfolios to avoid long-term exposure to climate events.

To do so, insurers need a more current and accurate understanding of risk in order to price it profitably or avoid it altogether. Geospatial analytics is one technology that can help achieve that objective. When integrated with an insurance core system platform, solutions from companies like Betterview and Cape Analytics leverage aerial imagery, computer vision, and predictive analytics to assess property risk instantly, on demand. Guidewire’s HazardHub can analyze and distill data from national sources to catalog risks that may damage or destroy property. It returns a risk score that insurers can use to determine whether they have an appetite for a given risk and under what conditions.

In confronting the 'code red' emergency of accelerating climate change, the insurance industry must embrace technological innovation, such as geospatial analytics and predictive analytics, to revolutionize risk assessment processes and proactively address escalating climate and extreme weather-related threats.

Dive deeper by reading Placing a Strategic Focus on Mitigating Climate Change Risk

2. Achieving a more sustainable insurance market by rebalancing risk

John Mullen, President and Chief Revenue Officer, Guidewire

The property and casualty insurance industry is grappling with a complex operating environment spurred by inflation, rising loss severity, and a constricted reinsurance market. This has led to pricing increases, greater volatility, and financial risk. Macroeconomic and investment performance challenges add further complexity to the landscape.

Consequently, some P&C insurers have withdrawn from key markets or restricted terms, underscoring the pressing need for the industry and individual insurers to take steps to rebalance risk. This issue transcends the P&C industry: policymakers, regulators, and insurers must work collaboratively to create an insurance market that is better equipped to serve consumers sustainably.

Insurers, individually and collectively, must embark on a journey to innovate and improve risk and portfolio management to meet the challenges of the current risk landscape.

Advanced analytics and modern portfolio management technologies can provide the adaptability and intelligence needed to navigate uncharted terrain and emerge with greater resilience.

3. Racing to the Future of Auto Insurance

Michael Anderson, Industry Advisory Lead, Guidewire

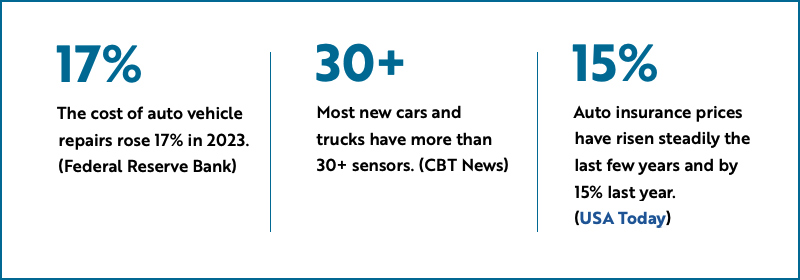

The auto insurance market is evolving rapidly, driven by technological, market, economic, and climate shifts. Insurers have seen dramatic increases in loss costs due to increased claims frequency, the technical complexity of today’s vehicles, increased part prices, supply chain issues, and more frequent weather events.

These challenges are further compounded by emerging technological trends such as vehicle connectivity, telematics, and the increasing prevalence of electric and autonomous vehicles, presenting both opportunities and complexities for insurers. Notably, consumer pricing is a significant concern, with a steep 15% increase in auto insurance prices last year. This necessitates reevaluating pricing models, pushing the market towards more personalized policies – and Usage-Based Insurance (UBI) and telematics to tailor premiums based on individual driving behavior, fostering more accurate pricing for consumers.

Moreover, the advent of autonomous vehicles introduces a paradigm shift in liability within the auto insurance landscape. As cars become more autonomous (Level 2 & 3), the responsibility for accidents may see some shifts from drivers to technology, hardware, or software providers. The evolving scenario prompts the need for clarity on liability assignment, the development of insurance products, and new claims processes specific to autonomous technology. Collaboration between automotive, insurance, and regulators is anticipated to increase to address these emerging concerns effectively.

Concurrently, the integration of Advanced Driver Assistance Systems (ADAS) into insurance models brings changes to the market and offers proactive approaches to reducing accident rates and related claims. As ADAS data becomes a standard part of insurance assessment, insurers are encouraged to adopt AI and predictive analytics to enhance risk evaluation, understanding the impact this technology has on claims frequency and repair costs. However, concerns over data ownership and privacy and ensuring system accuracy must be navigated.

In this dynamic environment, insurers must expedite their ability to adapt and innovate, incorporating strategies such as UBI, telematics, and vehicle data integration. Embracing these changes swiftly will help build more efficient underwriting and claims processes and facilitate the transition towards more personalized policies, cost savings for consumers, and increased competitiveness in the evolving auto insurance market.

Read more about The Future of Auto Insurance

4. Leveraging data wealth for customer and risk intelligence

Mike Quintal, Director, Go to Market Strategies, Guidewire

P&C insurers are confronted with a paradox: despite being data-rich, they often face challenges accessing the right information at crucial points in the insurance lifecycle. The abundance of granular data available presents an opportunity to enhance risk assessment, but traditional data and analytics approaches are becoming outdated in the rapidly evolving landscape of technology and data availability.

In this context, best-in-class insurers excel in three vital aspects. Firstly, a robust data strategy focusing on acquisition, processing, and integration becomes paramount. Embracing diverse data sources, including IoT data for residential properties and telematics data for automobiles, ensures preparedness for evolving market dynamics. Cloud-based APIs emerge as a key enabler, allowing the seamless integration of new data into core workflows.

Secondly, the adoption of next-generation analytics is crucial for effective risk selection and pricing. Insurers often grapple with data sourcing and risk model management challenges, unaware of available solutions to address these issues efficiently. Embedding analytics into workflows emerges as a critical success factor.

Embracing a comprehensive data strategy, leveraging advanced analytics, and seamlessly embedding insights into workflows are imperative for P&C insurers aiming to thrive in the dynamic market that lies ahead.

5. Towards a Seamless Future: Interconnectedness in the P&C Industry

Chris Cooksey, Senior Director of Advanced Analytics, Guidewire

Charles Clarke, Group Vice President, Guidewire Analytics

Interconnectivity and interoperability are emerging as a crucial trend in the P&C insurance industry, driven by the industry's digital transformation. Despite heavy investments in digitization and analytics, the lack of enhanced inter-company systems interoperability poses a significant challenge. The insurance sector, effectively built on information and historical data, is uniquely positioned to benefit from seamless connectivity and data sharing among stakeholders. The industry operates as a vast interconnected network, moving risk exposure and capital globally through a complex web of insurers, reinsurers, and intermediaries.

Digitization promises increased efficiency, enhanced customer experiences, and growth opportunities. However, a comprehensive digital strategy must prioritize seamless communication among industry peers and partners. Systems interoperability, or the ability to efficiently exchange granular risk information, models, analytics, and insights among partner entities, is essential for overcoming this hurdle.

To prepare for the future, insurers must focus on five key elements: (1) consuming external and internal data effectively, (2) analyzing data for insights, (3) driving decisions and changes in workflows, (4) modernizing customer interfaces, and (5) creating efficient inter-company communications.

Without interoperability, the industry's digital infrastructure will fall short of its potential. Insurers should prioritize interoperability in their digital strategies to unlock the full potential of digitization, foster collaboration, and address evolving customer needs in an interconnected insurance ecosystem.

Learn more by downloading the whitepaper: Do You Really Have a Digital Strategy?

Conclusion

The P&C insurance industry faces significant challenges but also significant opportunities. From rising loss frequencies to the climate crisis and auto insurance transformation, insurers will navigate a complex landscape. Guidewire executives will delve deeper into these topics throughout the year, engaging in discussions and producing insightful content. Stay tuned for our insights on these and other evolving issues, such as Digital Twins and Generative AI.