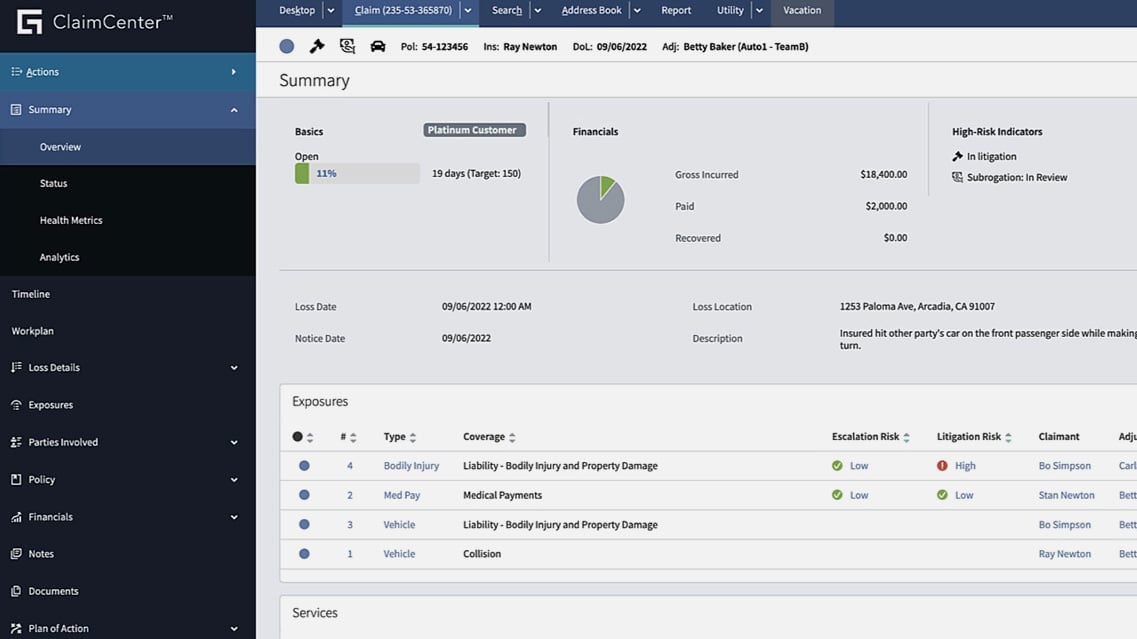

“We chose ClaimCenter because of the robust functionality that it offered. We chose Guidewire because of the company’s vision and commitment to the industry, commitment to evolve, and commitment to make the product meet the needs of its insurer base.”

Laurie Pierman

Vice President of Claim Operations