During the recent meeting of the Italian Observatory on Telematics and Connected Insurance, SwissRe presented a white paper, “Unveiling the Full Potential of Telematics”. Starting with a case study about motor insurance in the Italian market, SwissRe offered its perspective on the value of this technology to insurers and customers. I decided to write about this white paper because it sets out some simple points that, considered together, provide a concrete picture of how the Future of Insurance could look.

First: Telematics is growing, everywhere

In Italy, 16.2% of all motor liability contracts are now based on telematics. While this overall figure – still high – does not yet represent a dominance in the market, other numbers are suggesting an already clear domination:

Black box penetration is almost 50% in those regions of Italy with the highest claims frequency;

From 2012, black box penetration grew annually across all age groups, from 30% to 50%; and

The top 10 insurers in Italy all offer a black box product.

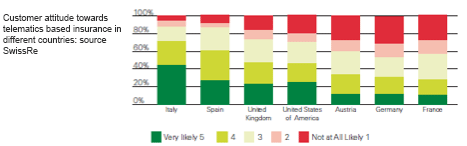

Italy is now showing figures that five years ago were only inferable by optimistic interpretations of market surveys. A recent one, commissioned by the Observatory on Connected Insurance, and undertaken by Survey Sampling International (SSI), provides interesting insights on how customers perceive telematics in seven different countries. In all of them, to varying levels, more than 50% have a positive attitude towards telematics-based insurance.

These figures are based on the value perceived by insurance customers regarding the telematics proposition to date, and this is only the tip of the iceberg, compared with the potential offering that we are starting to see.

Second: Good for customers, good for insurers

What we are starting to see about the telematics proposition is the consolidation of a win-win relationship between insurers and customers.

On the customer side, so far we have seen a strong accent on the possibility of premium discounts, sometimes through Pay As You Drive propositions, capable of turning fixed costs into variable ones, impacted by better performance resulting from fraud and theft. As mentioned earlier, this is the tip of the iceberg, since other new elements are rapidly coming to the fore, which allow insurers to personalize insurance even more and provide customers with real value:

Behaviour-based propositions (Pay How You Drive), integrating information gathered on mileage, with an analysis of the client’s driving style – such as the number and intensity of accelerations and stops, driving timetable, speed, location, weather conditions, time of day, day-of-the-week – could enable new savings, as well as increase engagement through gamification-like mechanisms.

Value-added services along the entire life-cycle of the vehicle usage. While driving, customers can receive bad weather and speeding alerts, or dedicated concierge services with alerts activated if the car leaves a pre-defined “safe area” (this can include family control options for young or elderly family members). In case of a crash, the customer experience can be improved more broadly by involving third parties, such as breakdown assistance providers. Solutions offered in case of an incident start with contacting the client proactively and – depending on the gravity of the event – sending help directly to the place of the incident, and handling all the logistics and case management issues that may arise. Other approaches can include looking at simplifying the First-Notice-of-Loss (FNOL) procedure, in case of car accidents. When parked, as well as locating and recovering the car in the case of theft, the black box can send alerts if the vehicle is moved or damaged in any way. This also includes locating a parked vehicle. One of the best examples in this respect is the street sweeping alert by Metromile, which was launched in Los Angeles and San Diego in 2015, which can help drivers avoid parking tickets.

Both factors lead to an insurance product that becomes more personal and valuable to customers.

And what about insurers? What is good for them?

The SwissRe white paper highlights three main benefits for insurers resulting from telematics usage:

Frequency of interaction, enhancing proximity with the customer, aimed at offering additional services. Many customer satisfaction surveys confirm that there is a clear link between customer satisfaction and the level of interaction with the company.

Benefits to the insurance bottom line, by increasing profitability through specialization. This includes the ability of telematics-based offerings to select risks automatically, influence driving behavior, and use collected data efficiently during the claims-handling process.

Knowledge creation about risks and customers, based on the combination of car data and contextual data. This will facilitate both the development of new risk models, which can be integrated with economic models for decision-making on specific insurance products, and the identification of cross-selling opportunities.

Third: Telematics will pervade the future of insurance industry

At a time when the decline of motor risk is predicted, telematics represents a breeze of opportunities for insurers. It is estimated that more than 100 million telematics-based policies will be in force by 2020, generating premiums exceeding €250 billion. Looking further ahead into the future, telematics represents the core technology behind all new trends in vehicle-based transportation, such as car-sharing or self-driving cars, and these developments will necessarily need a new motor insurance business model, where behavior, personalization, and services will be a must.

Not only motor, but many other lines of business will be transformed by telematics. Home, health, and commercial lines will all be able to take advantage of the new possibilities provided by Internet of Things (IoT): home products will be extendable with related services, for example, creating synergies with the anti-theft alarm market; health products will be able to focus on concrete prevention capability, as well as integrated wellness propositions; and commercial risks will be much more easily evaluated and monitored, thanks to sensors that will be able to track them.

Conclusion: Insurance to become lovemarks[](#_ftn1)?

With telematics, let us imagine a very changed industry, not only at an operational level, but also on a deeper basis, potentially with a redefined business model and relationship with its customers. It is not hard to envisage new business models, also built in partnership with related industries, providing the opportunity to realize that cultural shift from “adjusting” to “preventing” risk; with positive impact both for customers and insurers. These new relationships could be based on a different quality – and quantity – of interaction with the customer, providing the opportunity to serve them better, and to establish more trust and mutual satisfaction.

Very often blamed and denigrated, the insurance industry that we love has the capability now to take care of the communities it serves more effectively, to improve customer life quality, and eventually, to become – why not? – tomorrow’s lovemarks.