The nation has witnessed the devastation caused by Hurricanes Helene and Milton, which brought widespread destruction to Florida and across the Southeastern U.S., affecting areas from Georgia to North Carolina. While we are still assessing the damage caused by Milton, numerous media outlets, including The Washington Post, covered Helene and its aftermath in great detail. Many of these reports included statements from community leaders and homeowners surprised by the impacts, particularly inland, in places like the Macon, Georgia region, and Asheville and Buncombe County, North Carolina.

Yet, the hurricane and flooding risks in these areas should not have been a surprise.

Next-generation data and risk models available today provide much more accurate and detailed assessments of risk than were historically available from FEMA flood maps and other sources. Just two weeks before Hurricane Helene formed, HazardHub had issued its latest risk scores and maps for the U.S., explicitly highlighting Florida’s Big Bend, Georgia, and the Carolinas—including inland areas in Southeastern states—as high risk for hurricane damage and catastrophic flooding.

HazardHub Hurricane Risk Map for the U.S. Gulf Coast. Significantly more detailed community-level and address-level risk scores and maps are available to insurers and communities through HazardHub. Consumers can get free risk reports for their specific address at freehomerisk.com.

HazardHub's hurricane map (shown above) and storm surge map accurately detailed the areas of high risk affected by Hurricane Helene, particularly the extended area along Florida's Big Bend coast, where the storm made landfall.

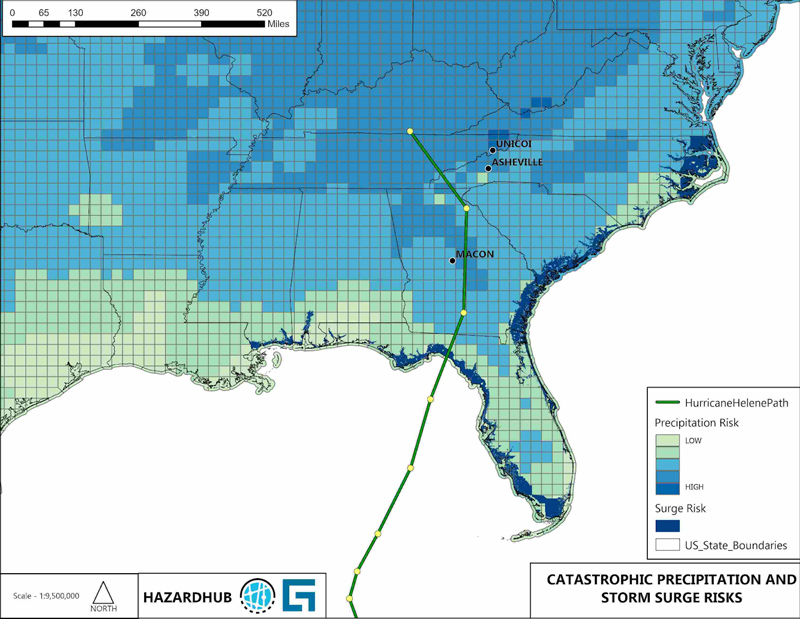

What is less frequently discussed, however, is the impact of Probable Maximum Precipitation (PMP) in an area. HazardHub’s catastrophic rainfall models and maps were highly predictive of the risk of inland flooding from Helene’s heavy rainfall, highlighting regions like North Georgia, Asheville, North Carolina, and Tennessee. The PMP data showed how these areas, despite not being in traditional flood zones, were at significant risk from catastrophic rainfall and subsequent flooding. FEMA Flood zones do not consider PMP.

HazardHub Catastrophic Precipitation and Storm Surge Map for the Gulf Coast and Southeast U.S. Significantly more detailed community-level and address-level risk scores and maps are available to insurers and communities through HazardHub. Consumers can get free risk reports for their specific address at freehomerisk.com.

As this hurricane swept through these populated regions, it left behind a trail of devastation that should serve as a catalyst for the insurance industry and community leaders to raise greater awareness about the risks posed by extreme weather and natural catastrophes—particularly hurricanes, storm surges, and flooding.

The Complexities of Hurricane Insurance Coverage

This includes educating the public about their insurance coverage and options. A survey by the Insurance Information Institute found that only about 27% of U.S. homeowners had flood insurance. A significant portion of those without it mistakenly believed their standard homeowner's insurance covered flooding or thought they didn’t need it because their area hadn’t flooded recently.

Hurricane coverage sourced through an insurer provides reimbursement for claims resulting from wind and wind-driven rain, typically with a large deductible based on a percentage of the structure’s replacement cost. Ancillary losses caused by storm surge, sewer backup, and flooding are not subject to this deductible and must be specifically purchased. Sewer backup must be added to a homeowner's policy by endorsement, usually with a sub-limit of $25,000 or $50,000.

The perils of storm surge and flood require a separate flood policy. The National Flood Insurance Program (NFIP), managed by FEMA, accounts for about 90% of all such flood insurance coverage in the United States. The NFIP was established to address the lack of affordable flood insurance and promote floodplain management. The NFIP provides flood insurance coverage for coastal and inland flooding, protecting properties and personal belongings that standard homeowners' policies typically do not cover. To keep premiums reasonable, the NFIP limits coverage to $250,000 for the dwelling and $100,000 for the contents. It doesn’t cover additional living expenses. Homeowners must apply for individual assistance if this is needed.

Many homeowners don’t realize they are uninsured or under-insured for storm surge and flooding, especially those outside FEMA-designated flood zones. They also may not be aware coverage is available to them. Improved risk maps can help property owners better understand their exposure and determine if a private flood policy would be beneficial.

Challenges with the NFIP and the Need for Better Risk Data

While the NFIP plays a crucial role in flood insurance, it has faced criticism for its shortcomings. These criticisms underscore the need for more accurate, data-driven risk assessments to supplement the information FEMA provides. For example, a property may be outside of NFIP coverage but within a high probable maximum precipitation region, and this information could alert a property owner to secure additional flood coverage.

Insurance carriers, claims adjusters, and thus homeowners often face challenges post-event in verifying the causes of loss to trigger the proper coverage. For example, water damage from a broken window or missing roof is covered by hurricane insurance, but water entering the home from flooding or storm surge is not. And what if both occur simultaneously?

A recent article by The Washington Post emphasized how underinsurance in flood-prone regions exacerbates financial losses for individuals and communities. The article highlights the policy gaps in current flood insurance offerings and underscores the need for improved disaster preparedness and more effective flood insurance strategies.

How Guidewire’s HazardHub Can Help Address Flood Risk

HazardHub provides a more comprehensive, accurate, and up-to-date assessment of flood risks beyond the 100-year floodplain, offering a solution to the biggest shortcoming of the NFIP: its applicability outside the 100-year floodplain. Here’s how HazardHub’s risk models and data improve risk assessment and mitigation:

- Accurate and Updated Risk Mapping: HazardHub uses advanced data analytics and modeling techniques to create detailed and frequently updated risk maps. Unlike the NFIP's information, it offers a current assessment of flood risks within and outside traditional floodplain boundaries.

- Expanded Risk Assessments: HazardHub’s data includes a broader range of water bodies, including smaller tributaries and streams often overlooked by the NFIP. This granular analysis provides a more thorough risk evaluation, identifying properties at risk that might not be classified as flood-prone by traditional methods.

- Enhanced Risk Scoring: By providing FEMA flood scores alongside storm surge potential, flooding, catastrophic flooding, and historical flood events, HazardHub enables both the public and insurance industry to consider a broader range of risk data. This allows insurers to better understand and underwrite flood risks.

- Proactive Risk Management: HazardHub provides access to detailed risk data, allowing property owners, insurers, and communities to understand risk levels and take proactive measures to mitigate flood risks. A data-driven approach aids in identifying areas needing better floodplain management, targeted mitigation efforts, or stricter building codes. Reducing the protection gap will help communities recover more quickly after an event.

- Support for the Private Insurance Market: With accurate and comprehensive risk data, HazardHub enables private insurers to assess and underwrite flood risks confidently. This supports the growth of the private flood insurance market, offering alternatives to NFIP policies and improving market competition. Private insurance can provide more tailored coverage options, higher coverage limits, and risk-based pricing, which can better meet the needs of homeowners and businesses.

While the NFIP remains the primary source of flood insurance for many property owners, private insurance is increasingly viewed as a complementary option or alternative, offering flexibility and competitive pricing. The availability of private insurance helps fill the gaps left by the NFIP, especially for properties outside designated flood zones or in areas with more complex risk profiles.

Conclusion

As we witness the increasing severity of storms like Hurricanes Helene and Milton, it’s evident that greater awareness and proactive risk management are essential to safeguarding our communities and homes. Accurate, up-to-date data and risk assessments are no longer optional—they are critical tools for insurers and homeowners to prepare for inevitable disasters.

HazardHub’s advanced risk models and scores provide the insights needed to better understand these risks and guide meaningful steps toward protection and resilience. Now is the time to prioritize improved risk assessments and explore expanded coverage options.

Insurers can learn more about HazardHub's hurricane data, risk scores, and maps in this release, browse the hundreds of data points and risk scores available through HazardHub, or try HazardHub for free.

Consumers can access a free risk report for their individual property at freehomerisk.com.