Why pricing conversations across insurance lines are so complex

Believe it or not, one of the biggest obstacles in insurance pricing isn’t the complexity.

It’s the confusion.

Insurance pricing can mean different things to different people. For instance, pricing actuaries focus on their studies and models and call it pricing. Meanwhile, commercial underwriters see those models as just the starting point. To make things more complicated, the many parts of pricing are often lumped together under one term for convenience – causing little trouble when speaking with like-minded professionals.

Insurance pricing can mean different things to different people.

But sit back and watch the confusion unfold when a U.S. personal lines professional starts talking with a London Market commercial underwriter. Without establishing the right context, both will use similar words to describe completely different activities.

In Part Two of our three-part series on overcoming insurance pricing challenges, we break down the most important pricing terms to create clarity across the industry. As we’ve seen, definitions can vary by line of business, region, or even within the same organization, making it hard to get everyone on the same page.

Of course, no single definition will work for everyone. But when pricing professionals share a common understanding, it’s easier to collaborate, make informed decisions, and focus on strategy instead of semantics. By laying out important terms in a clear and consistent way, we’re providing a framework that professionals can adapt to their own contexts – cutting back confusion and keeping pricing discussions on track.

Defining "pricing" in insurance and clarifying key terms

Many people refer to their own activities as “pricing” when, in fact, they’re one part of the process. Throw in “rating” as a separate activity, and there’s greater need to be more precise in how we use our terms. Consider that when analytics teams build their pricing models, they’re determining the rates to be charged. Meanwhile, rating engines calculate a price for a given insured.

Could we make this any more confusing?

Pricing is the process of determining what to charge (premium) for a given customer when selling insurance.

The key point? Pricing is how we determine the premium for a given customer. But we also need to talk about how we decide the premium for given classes of customers.

Many personal lines practitioners don’t think of this as a specific step to call out – it’s simply the application of predetermined rating rules (a rating plan). For pricing actuaries, the real work is done in the creation of the rating plan (more on this below). The rating engine that applies these rules is “just” a calculator, but it’s still a necessary step. One that needs to be done quickly and accurately, as this process determines the premium a customer will pay.

In commercial insurance, pricing is more complex, so it’s worth calling out how premiums are set. Predictive models are still built in these lines and may result in a technical premium, but in most cases, this serves only as the starting point for underwriters. The real pricing process is driven by underwriting activities and risk evaluation, which is what ultimately determines the final price.

The key point? Pricing is how we determine the premium for a given customer. But we also need to talk about how we decide the premium for given classes of customers.

Rates are the premiums we would charge for any customer that meets the definition for that rate.

Rating plans are a collection of rules that specify premium for any prospective customer who meets the company’s underwriting criteria.

In personal lines, rates and prices can become conflated because there’s no subsequent step after the rate for a customer is determined. But it’s still helpful to distinguish between rates, which refer to premiums for groups of customers, and prices, which are paid by individual insureds.

Ratemaking is the process of determining the rating plans.

Predictive analytics and models are often used to determine a data-driven technical rate – the premium one would charge based on data. This activity is more properly called ratemaking than pricing and is the term used in actuarial circles. Even in personal lines, while rating plans are often based on these predictive models, their final form usually includes other business considerations, as well. This is also true in commercial lines, but with the added, explicit acknowledgement that data-based models cannot capture all of the relevant risk factors. Hence, the need for expert underwriting.

Pricing function refers to this entire process of determining and maintaining what rates to charge and executing these rates in practice.

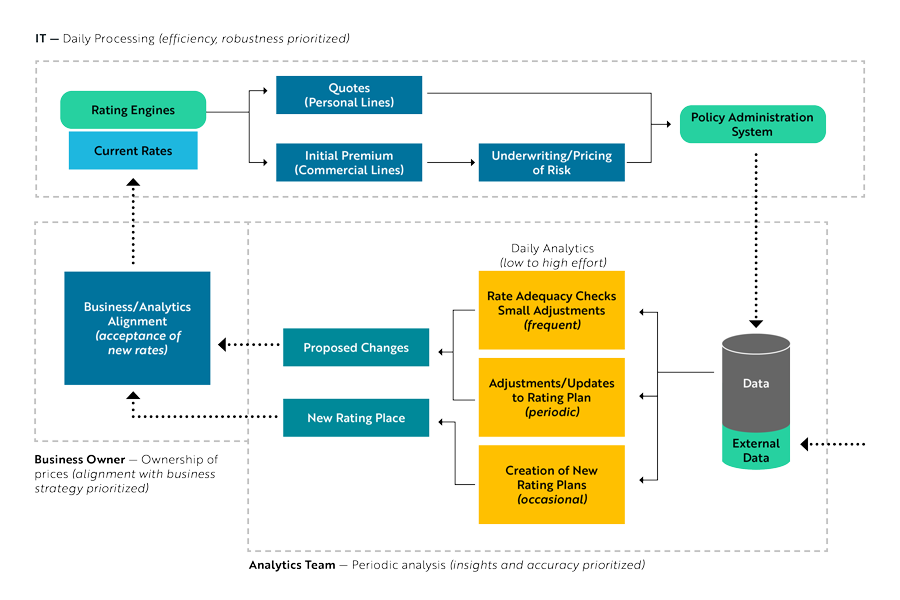

The diagram included here is a simplified version of the pricing function, with a particular emphasis on the cadence of different activities – daily processing versus periodic analysis – that make up the pricing function. Note that three distinct stakeholders play different roles in the process, each with differing priorities, tools, and approaches that lead to painful and inefficient disconnects in many insurance companies. See part one of our series, which explores why pricing is a difficult business problem to solve.

For personal lines, the pricing function includes the analytics behind rates, the decision process for turning these models into business-ready rating plans, and the execution of these plans through rating engines, such that individual customers can be priced.

For commercial lines, the pricing function includes any analytics that might provide a technical, starting-point premium or other information used in pricing a given risk (for instance, the expected impact of climate trends or inflation). It includes the underwriting process, which gathers all of the relevant information, including initial rates from a rating engine, and results in a price to be offered to the customer.

Stepping back for a bigger perspective, the pricing function includes the studies that tell you what you want to charge, the evaluation of a given customer to determine what you will charge, and the technical execution of this price.

Making Smarter Insurance Pricing Decisions Through Clearer Conversations

Pricing works best when everyone’s on the same page. But, depending on who you ask, the same words can mean very different things, causing confusion and missed opportunities. That’s why a shared understanding is essential. When pricing conversations are clear and focused, teams can focus on what really matters – better decisions, smarter strategies, and solving challenges that actually move the needle.

Now that we’ve come up with a common language for pricing conversations, the final step to unlocking pricing success is taking a hard look at whether you’re truly comfortable with how your company sets premiums.

Chances are you’re not – and for good reason.

Based on insights from over a dozen pricing experts, Part Three of our series reveals a framework to help you pinpoint exactly where your pricing process may be falling short and what to do about it. In the end, you’ll be making pricing decisions with clarity and confidence. Stay tuned.