The small- and medium-sized business (SMB) segment represents a compelling growth opportunity for insurers. However, due to the lack of information on small businesses, a common challenge for insurers in the small business workers’ compensation market is identifying risk differentiation between similar types of small venture entities. Insurers are looking at information that is only the tip of the iceberg during underwriting, leading to potential adverse selections and putting book profitability at risk.

Continuous Digital Underwriting Approach

Imagine an SMB insurance landscape where information about a risk is automatically available on-demand. Information that is not only “black and white”, like hours of operations, the availability of delivery services, or whether the business has HR policies properly documented, but also intangible, such as behavioral information on whether policies are being observed, management follows best practices in general, and so on. At Guidewire, we enable data-driven underwriting by gathering and highlighting the most useful external and internal data to help differentiate risk, which in turn guide segmentation, risk selection, and pricing decisions – an approach we call Continuous Digital Underwriting.

This unique approach will allow an insurer to do more sophisticated segmentation and target the best risks to write. Having this additional access to data and analytics will enhance straight-through processing for it to be applied in most cases, allowing agents to focus on more complex scenarios. This access to “always on” data could also help insurers assess risk throughout the lifespan of a policy and provide coverage and pricing recommendations automatically. In addition, the client experience could be enhanced by having pre-filled applications and asking fewer questions. All of these benefits pave the way for a “smart insurance” operation.

Guidewire Cyence for Small Business™ for Workers’ Compensation

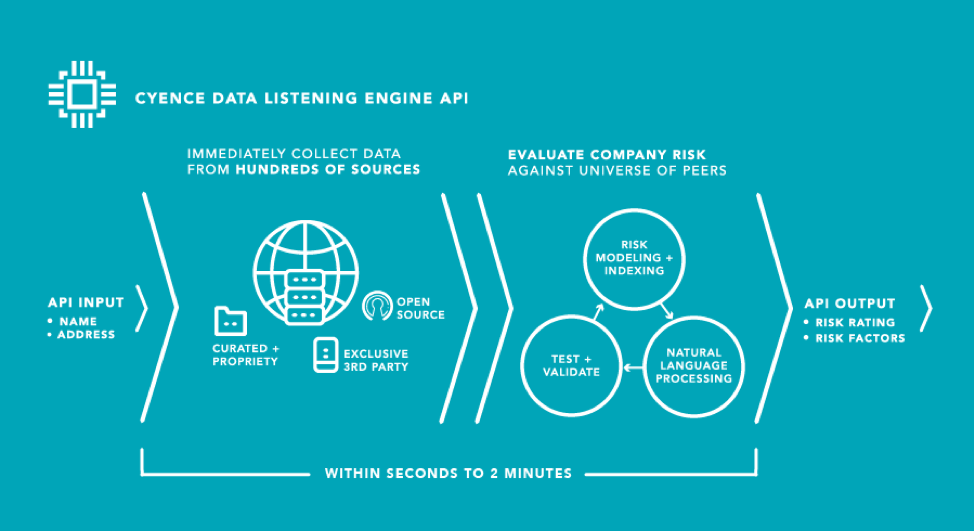

Continuous Digital Underwriting is put into action with the general availability of Guidewire Cyence for Small Business™ for Workers’ Compensation – an on-demand risk assessment engine that delivers company-specific risk rating and risk factors in minutes. Accessed via a RESTful API, this cloud-native solution expands insurers’ risk appetite for workers’ compensation by augmenting the traditional underwriting process with out-of-the-box risk models powered by machine learning and non-obvious external data – all while enabling a streamlined, frictionless experience for small business owners.

A diagram showing Cyence for Small Business for Workers’ Compensation RESTful API

For example, two hardware stores with the same number of employees and approximate revenue may look like similar risks as illustrated in the diagram below. With Cyence for Small Business™ for Workers’ Compensation, non-obvious data on the two stores is analyzed, such as services provided, business hours, neighborhood crime rate, street foot traffic, and proximity to a hospital. As a result, the risks between two businesses suddenly look very different and therefore will impact the pricing decisions. By having access to real-time, non-obvious data sources, insurers can complement existing underwriting processes to more easily differentiate risk for protected profitability.

A before-and-after diagram showing Risk Differentiation

For more information, please view our webinar – Enabling a Continuous Digital Underwriting Approach.