Key Summary

Fire suppression scoring is used by insurers, reinsurers, agents, and brokers to evaluate a building's propensity for damage from fire and the ability of local fire crews to respond quickly. Fire suppression scoring involves assigning both a quantitative and qualitative score to a building’s location.

When pricing or underwriting fire insurance, actuaries and underwriters agree on the need to consider many factors such as the building's location to nearby fire suppression resources (fire stations, hydrant requirements), building characteristics (age, size, construction materials), and the presence of on-site fire protection systems (sprinklers, smoke detectors, alarms).

HazardHub Fire Suppression Score (FSS) covers additional critical criteria like distance to water sources, drive time from fire stations to the property, fire station staffing, and more. HazardHub Fire Suppression Score is used in the P&C insurance industry - specifically, by underwriting, product management, and actuarial departments within insurers, reinsurers, and agencies - to make more informed decisions about risk exposure.

Guidewire HazardHub

From fire risk to flood risk, HazardHub has 1,400+ P&C risk factors that provide real-time risk data for your U.S. property.

Guidewire HazardHub Risk Data

Property and casualty insurance risk data is available to improve risk assessment and portfolio management in seconds.

What Are the Features and Benefits of HazardHub Fire Suppression Score?

HazardHub FSS assesses fire risk above and beyond other fire scoring tools, with scoring that support better decision making for property insurers, reinsurers, and managing general agencies.

Features

- HazardHub FSS scores fire protection at the address-level.

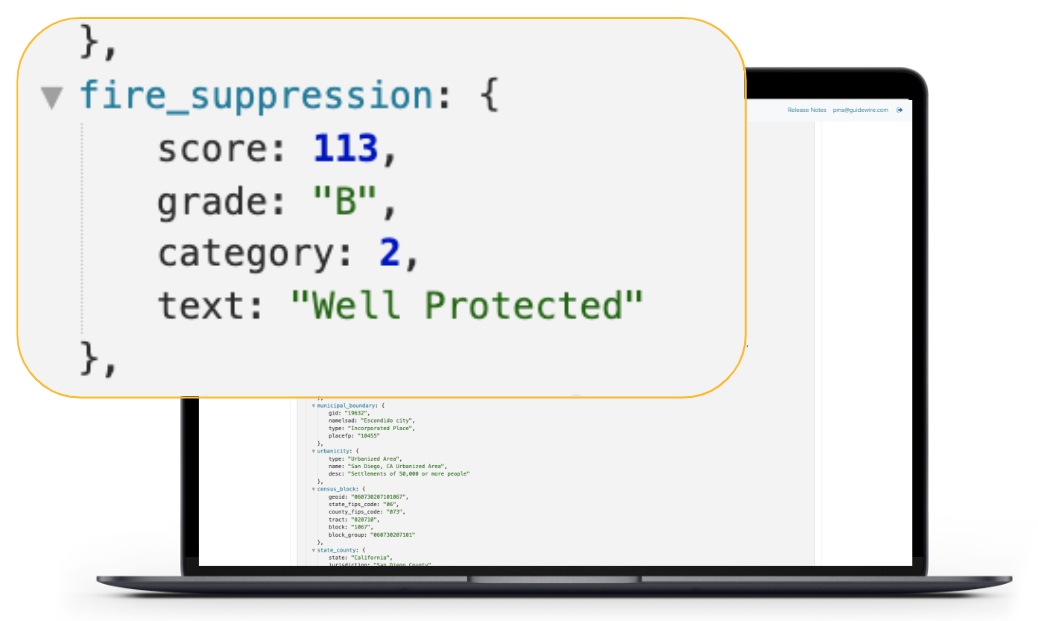

- Returns relativities, grades, and categories depending on the granularity needed.

- Relativities range from 100-300, with 100 being the best. Grades range from A-F, with A being the best. Categories range from 1-10, with 1 being the best.

- The score is based on many critical factors including distance to water, real-world losses, fire station density, drive time, and staffing levels.

- Model validated with over 50,000 property insurance claims.

- Available now through the HazardHub Property Risks API.

- Get 900+ additional risk factors for multiple perils and hazards with FSS.

Benefits

- Differentiate Risk More Accurately: HazardHub FSS scores properties at the address level on a scale between 100-300, allowing insurers to clearly differentiate fire risk for properties within the same community. There is more granularity in the scoring between properties allowing insurers to differentiate risks within the same neighborhood or fire district.

- Improved Underwriting: HazardHub FSS helps underwriters identify potential risks and opportunities in underwriting, allowing them to make more informed, accurate, and immediate accept/decline decisions.

- Improved Pricing & Profits: Insurers can set premiums that accurately reflect the fire risk of each property, offer fire policies to properties previously deemed too risky to price based on incumbent classification systems, and expand market opportunities for profitable business with any distribution strategy.

- Gain a Competitive Advantage: HazardHub FSS helps insurers gain a competitive advantage over those that do not use FSS. Enhanced scoring allows for additional fire risk insight on properties, faster underwriting decisions, and the ability to set accurate pricing for all policyholders.

Learn More: Blog: "A New Approach to Fire Protection: HazardHub Fire Suppression Score"

How is HazardHub Fire Suppression Score Determined?

HazardHub Fire Suppression Score is based on multiple critical factors including fire hydrant location, drive time to the nearest fire station, staffing at the fire station, and the next three closest fire stations.

How is HazardHub Fire Suppression Score Different and Better Than Traditional Fire Scoring Tools?

Traditional fire scoring tools rate properties based, in large part, on their distance to nearby fire stations or on training and equipment. Then they apply the same score for entire fire districts. HazardHub considers multiple critical factors around each property and determines fire risk for each location.

Therefore, houses in the same fire risk district or neighborhood can score differently. This enables insurers to differentiate risk within neighborhoods and underwrite fire risk at properties more accurately.

What Are The Most Common Use Cases for HazardHub Fire Suppression Score?

HazardHub Fire Suppression Score can be used by any entity needing insight into the fire risk of properties. We see fire suppression scoring used mostly by insurers, reinsurers, and managing general agencies.

Specifically, insurers are using HazardHub FSS for underwriting and pricing:

- For underwriting: Insurers use HazardHub FSS to supply their underwriters with accurate and precise fire risk information about the properties that they are underwriting. This enables underwriters to make faster and more accurate underwriting decisions.

- For pricing: Insurers use HazardHub FSS to set accurate premiums on properties that reflect the true fire risk of that structure. Furthermore, insurers can also use HazardHub FSS to price properties deemed too dangerous to underwrite by other fire risk scoring tools.

Learn More: White Paper: "Fire Protection Classifications and Fire Severity: Is there more to the story?"

About Guidewire

More Articles

Resources

DOWNLOAD: Feature Brief: HazardHub Fire Suppression Score

DOWNLOAD: White Paper: Fire Protection Classifications and Fire Severity: Is there more to the story?

READ: Blog: A New Approach to Fire Protection: HazardHub Fire Suppression Score

WATCH: Webinar: An Incredibly Better Way to Assess Fire Risk