P&C insurance is fundamentally a business of making predictions and executing on them. These predictions are diverse and very complicated, ranging from claim frequency and fraud likelihood, to policy profitability, cost of loss, payment delinquency, and subrogation.

Getting these predictions right can be exceedingly difficult because they require a critical mass of high quality data -- data which is often prohibitively expensive, inaccessible, or plainly unavailable.

This difficulty is faced by insurers of all sizes, in all regions, in every market segment because historical loss and premium data is fragmented. For example, personal lines carriers often lack the historical data to make credible predictions about commercial lines risks, and vice versa. Regionally focused carriers have exceptional insight in their states of operation, but have trouble forecasting loss trends in other parts of the country.

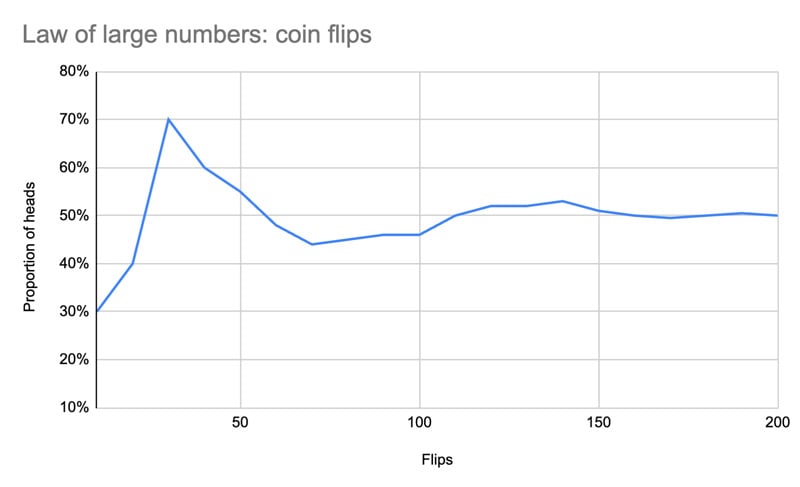

These challenges can largely be overcome with scale. Collect enough data of sufficient quality, and the "law of large numbers" will kick in and improve each prediction made by the models consuming this data. When it comes to aggregating high quality data, bigger is almost always better.

Consider the case of a coin flip, where the expected value of getting "heads" is 50%. After 10 flips, it is unlikely that heads will have turned up exactly 5 times, but after 100,000 flips the percentage will be very close to the expected value of 50%. The same concept applies to insurance data: the greater the number of policy and claims observations, the more accurate the prediction can become.

Guidewire is pleased to contribute to alleviating this industry-wide data challenge with the introduction of Guidewire Industry Intel. Based on claims and exposure data comprising more than $200 billion in global premium, Industry Intel will enable participating members to make accurate, fast, and actionable predictions in their core system screens where they are needed the most, throughout the policy and claims lifecycles.

Actuaries will also benefit from Industry Intel in several ways: first, they can use the scores generated by its models to supplement their own predictive modeling efforts, particularly when their own training datasets are too sparse. Second, they can receive industry trending data provided by Guidewire to better understand changes in the claims and underwriting landscape. Finally, they can access industry claims benchmarks using the Compare application.

With the Las Leñas release, Guidewire will publish the first four industry models for auto subrogation, claim severity, litigation likelihood and attorney representation. Insight from these models will be directly embedded into ClaimCenter with predictions, context, and operational recommendations. Further claims models, and eventually underwriting and profitability models, are planned in 2025.

—-- INFOBOX —----

What: Guidewire Claims Intelligence Models

Predictions: Auto Subrogation (recovery probability), Claim Severity (binned range), Attorney Representation & Litigation Susceptibility (susceptibility score)

Value Proposition: Identify most important claims at FNOL, optimize adjuster assignment, achieve faster claim closure and lower indemnity payment.

Access: Inside ClaimCenter or via Predict API

—------------------------

The dataset underlying Industry Intel provides useful insight into many of the challenges the industry faces, as well as current trends. For example:

-

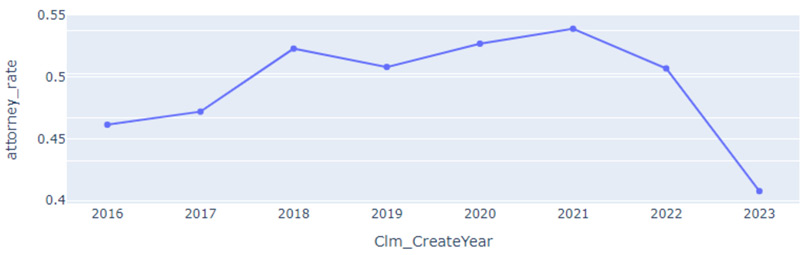

Attorney representation in auto claims trended upwards from 2016 to 2020 and may have peaked during the pandemic.

-

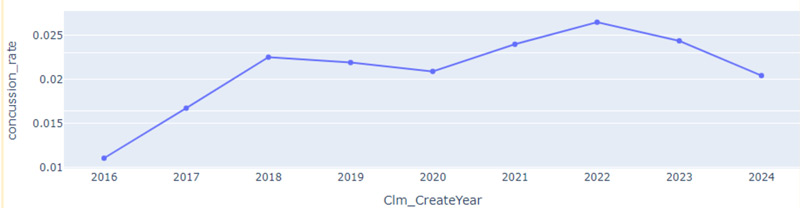

Concussion rates have increased over the past decade, potentially adding to claim severity pressures observed throughout the industry.

-

Though relatively infrequent, claims involving off road vehicle accidents are very highly litigated.

Figure 1: Concussion rates by year, Guidewire Industry Intel dataset

Figure 2: Attorney involvement by year, Guidewire Industry Intel dataset

Industry insights derived from Industry Intel will be continually presented to participating insurers as a means to identify early warning signals, both in their own portfolios as well as in the industry overall.

These early warning signals are increasingly important to identify because the downside risks (and upside opportunities) facing P&C insurers are far greater than they were a decade ago. The simultaneous challenges of climate change, economic inflation, and increasing litigation have put strains on carriers' top-line profitability. But those who act fast can offset these challenges by leveraging tools previously unavailable to them: cheap computational power to train models, new forms of AI that can reduce operational cost, and higher volumes of predictive data. Our ambition is that Guidewire Industry Intel will contribute to this incredible toolset.

For more information, contact info@guidewire.com