Guidewire European Insurance Consumer Survey 2025

See the trends that are impacting insurance behaviour in France, Germany, Spain, and the UK.

The View of the Crowd

Even though worries about the macro-economic environment are still very present, the perceived relevance of insurance has grown alongside positive sentiment towards insurers.

However, customers remain worried about the cost of living.

In 2025, 84% of people say that they are concerned about the rising cost of living, which is slightly less than last year’s 85%. Around 1 in 2 (52%) say that they are likely to cut their spending on insurance.

Notwithstanding this, views of the industry are more positive than last year.

- Having consistently risen each year, the view that insurers are necessary but inconvenient has fallen from 36% in 2024 to 30% in 2025.

- By contrast, those who say that insurers understand them and that they value insurers’ products has risen from 24% in 2024 to 32% in 2025, which is 12% higher than it was in 2022.

- The number who say that they do not think the insurance industry did enough to help people in need has fallen by 10% from 29% in 2024 to 19% in 2025.

- Those that say that their view of insurers has not changed in the last 12 months and is negative has also ticked up from 20% in 2024 to 25% this year, while those that say they have not changed and hold a positive view has risen from 19% to 34%.

That perceptions have turned around to such an extent is clearly a positive and will help with opening new opportunities for insurers.

One of these opportunities could be in attracting new talent into the industry.

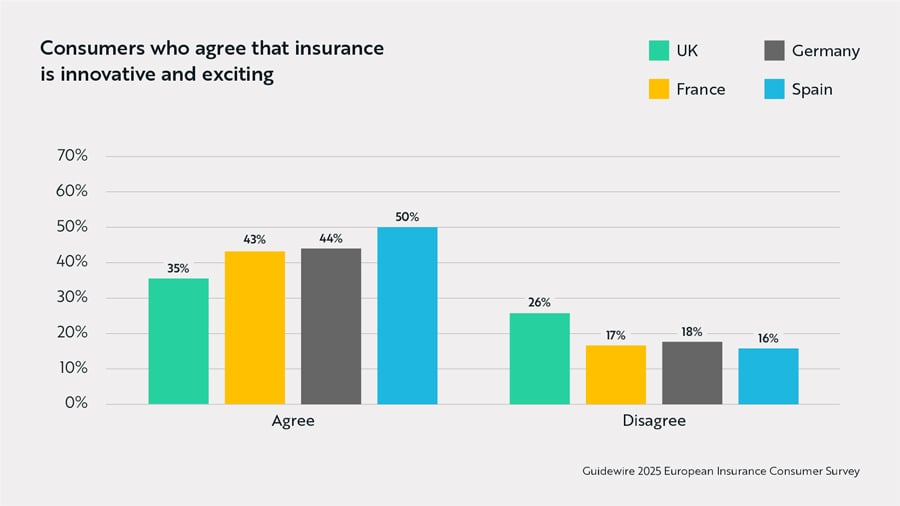

- The number who think that the industry is an exciting and innovative place to work has grown from 37% in 2024 to 43% in 2025. This increase has been most prominent amongst those aged 25-34, where it has risen from 44% to 57%, and those that are 35-44, where it has gone from 40% to 45%.

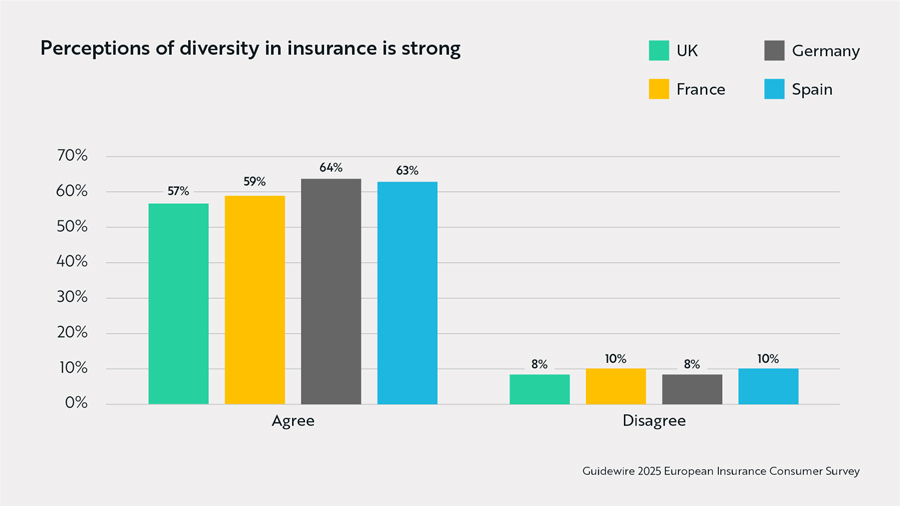

- Likewise, the number of people who think that insurance is a diverse industry where you get to work with lots of different people has grown from 57% to 61%. Again, there are similar increases for those aged 25-34, rising from 59% in 2024 to 69% in 2025, and 35-44, going from 57% to 60%.

The Rising Tide of Claims

Insurers are experiencing an increase in the number of claims from policyholders.

More than one in three (36%) customers said that they had made a claim in the last 12 months, an increase from 31% in 2024 and 27% in 2022.

- What is driving the significant increase in the overall picture are large increases in Germany and Spain.

- In Germany, the number of people who have claimed has risen from 46% in 2024 to 54% in 2025, marking the first time in the survey’s history that more than half of those surveyed in a market have claimed in the previous 12 months.

- In Spain, the number who have made a claim is 41% in 2025, growing from 32% in 2024 and vastly higher than the 25% seen in 2022

The picture is different elsewhere.

- The number of claimants in France is consistent with previous years, being 34% in 2025 compared to 35% 2024 and 34% and 33% in 2023 and 2022, respectively.

- The UK is far more volatile, with claims yoyoing year-on-year -12% in 2022, 17% in 2023, 12% in 2024 and then 16% in 2025.

For insurers, long-term growth in the frequency of claims is clearly concerning and is putting pressure on loss-ratios, especially when customer loyalty is as fickle as it is.

Policyholders Are Still Switchers

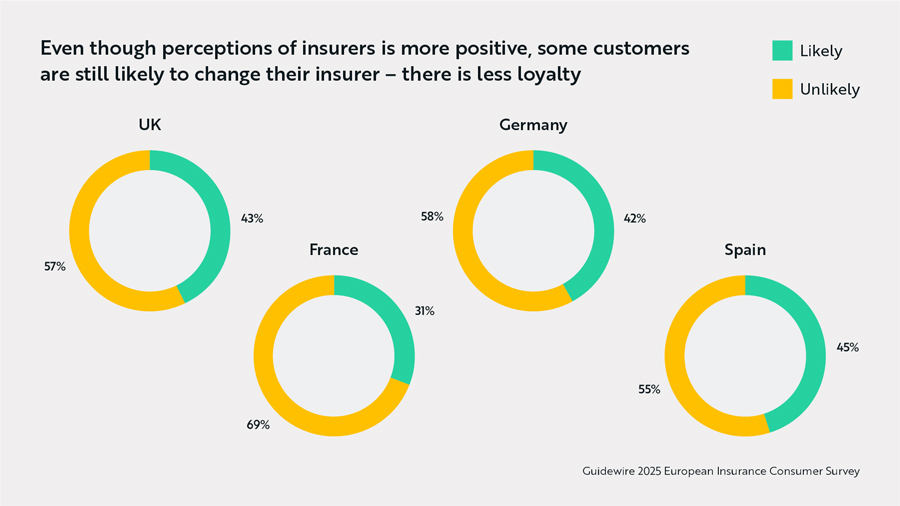

While positive sentiment towards insurers is up, the likelihood of customers to consider switching is still high.

- Four in ten (40%) of all those surveyed say that they are likely to cancel their policy and switch to another insurer, which compares to 42% in 2024.

- France does buck the trend where the growth in the number of people who think that insurers value them and say they value insurer’s products has translated into fewer people that are likely to cancel and switch. French customers who say that insurers understand them and that they value their products has risen, from 20% in 2022 to 31% in 2025. In 2024, 40% of these people said that they were likely to switch, but in 2025 this has fallen to 31%.

Some customer turnover is inevitable, but the combination of rising claims and the cost of customer acquisition means that driving greater brand loyalty must be a key focus.

Improving Customer Service

There are fewer changes in customer attitudes to their service interactions with their insurer.

- On whether the customer service agent had all the information needed to help them, most (67%) said yes which is only up 1% compared to 2024. Those who say they did not have the right information stays the same (18%) as in 2024.

- Traditional channels to contact an insurer with a claim are still preferred but are becoming slightly less popular. Those that prefer to contact their insurer by phone has fallen from 66% in 2024 to 58% in 2025, and email has dropped from 43% to 40%.

- Insurance-specific digital channels are growing in preference. Mobile apps are the most popular option across all markets, with significant growth in popularity of 6% in the UK (26%) and Spain (32%), and 7% in France (25%). In Germany, the greatest change has been in the popularity of website chatbots, which has increased from 10% in 2024 to 18% in 2025.

- Few customers seem to like cross-over applications with social media platforms. Only 10% say that they would file their claim via a social media platform, with the largest proportion of these people found in Germany (13%).

- The human touch is even more cherished. Having an insurance agent file a claim has increased from 9% in 2024 to 17% in 2025, returning to levels seen in 2022 (19%) and 2023 (15%).

With customers willing to switch, building brand loyalty through excellent customer service is critical. Insurers need to ensure that customer service agents are armed with systems that mean that they can help customers when they need it most, while making digital services available that allow people to manage their policy and claims themselves when they want to.

Interest Grows in New Insurance Models

Over the last four years, we have seen consistent customer interest in new products and services driven by technological innovation. 2025 is no different.

- Smart tech warning services to alert them to potential damage before it happens continues to appeal. Interest has risen from 71% in 2022 to 80% in 2025. Customers in Germany (85%) and Spain (86%) are especially interested but interest is higher in all markets than it ever has been.

- Interest in Usage-Based Insurance (UBI) products has grown. The number with a UBI policy is 31% in 2025, having been 24% in 2024. In the UK, customers with a UBI policy has doubled to 20%. There has also been significant growth in Germany (34%) and Spain (32%), both of which have increased by 6% on data from 2024.

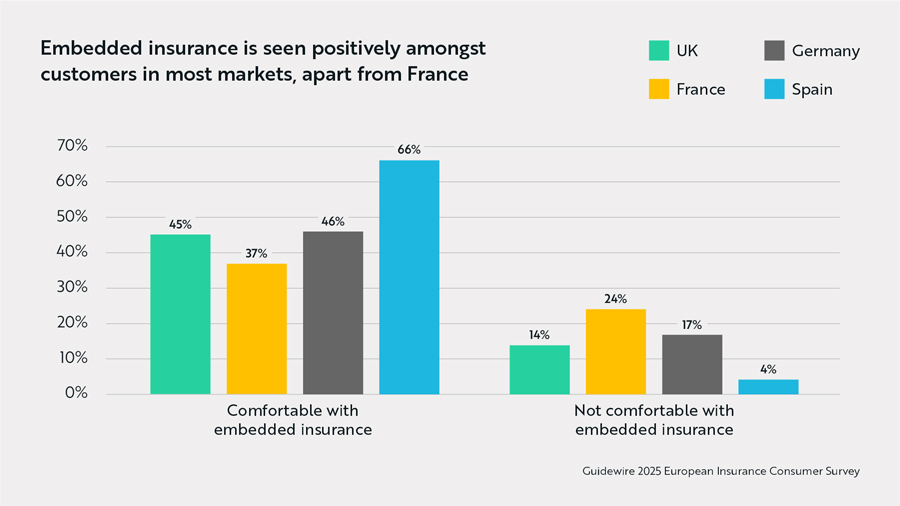

- Embedded insurance is becoming more popular. The level of comfort people have with companies like IKEA, Tesla and Amazon offering insurance products has rebounded to levels last seen in 2022.

- Almost half (48%) say that they would be comfortable with buying an insurance product alongside the purchase of goods from one of these companies, after it had fallen from 50% in 2022 to 44% and 45% in 2023 and 2024, respectively.

- In the UK the increase is most marked from 39% in 2024 to 45% in 2025; and Spain saw a big jump from 56% to 66%.

Technology innovations that deliver clear value are making inroads but new modes of insurance like UBI and embedded do invite new competition who are more digital-first into the market. Insurers need to ensure they maintain a role here.

Brand Still Matters

The good news for insurers is that when it comes to the things influencing where we buy insurance from, familiarity is king.

- A known insurance brand (38%) is still the biggest factor and remains as influential as it was in 2024 (37%1).

- The next biggest factor is that people have always used that insurer, which is at 28% in 2025 having been 25%2 in 2024.

- Friends and family have risen in influence. Those swayed by whether a friend or family member uses an insurer has risen by 6% since 2024 to 25%. It should be noted that for those who say that they are likely to cancel and switch their policy, whether a friend or family member uses that insurer is the second most influential factor (25%), after it being a known insurance brand (36%).

- Brokers matter more than before. The number of insurance customers who are willing to trust the recommendation of their insurance broker has risen 6% to 16% in 2025. This is most prominent in Spain (21%), followed by the UK (17%) and Germany (16%).

This, plus overall positive sentiment toward the industry, is good news for the larger players, but that is not to say that they can be complacent. Given the willingness and the growth in new insurance models like UBI, working hard to unlock innovation is key to earning trust through communication and customer service.

Building More Trust in Data Privacy

For insurers to innovate and offer more responsive services and products, the industry must be able to collect and process more high-quality data.

However, customer attitudes may be heading in the wrong direction.

The number who say that they do not understand why insurers would collect data from connected devices to better understand risk and see it as an invasion of privacy has risen from 19% in 2024 to 24%. While it was higher in 2022 (27%) it had subsequently fallen, suggesting a reversion back to a more privacy-conscious mindset.

Looking at the country-specific level, however, we do see clear differences in people’s willingness to share data.

- France is the country in which there is the strongest opposition, with the number of people saying that they think it is an invasion of privacy increasing 8% from 2024 to 28% in 2025, the highest it has ever been.

- Spain has also seen a significant increase in concern, albeit from a lower base, with 21% saying that they think it is an invasion of privacy, 5% higher than in 2024.

There is more positivity elsewhere. In the UK, the number who think that insurers collecting data is a good thing that will improve services and reduce prices for low-risk policyholders has risen from 28% to 32%. In Germany, there’s similar growth from 32% in 2024 to 38% in 2025.

- When it comes to the data that people are willing for insurers to track through sensors and connected devices, home heating (28%) and plumbing (28%) are still the most popular options.

- However, people are most comfortable with real time data about their driving to be collected, increasing from 20% in 2024 to 26% in 2025, the highest it has ever been.

- There have been increases in interest across all markets, with comfortability growing by 7% in the UK and France, 4% in Spain, and 12% in Germany.

It should be noted that real time data on driving is also the most popular answer amongst those that think that insurers collecting data is a good thing (39%). These people are most likely to be in the 18-24 and 25–34-year-old age brackets, pointing to an opportunity for insurers to target these younger consumers with such offerings.

12024 results included only French and UK respondents

22024 results included only French and UK respondents

Customers Warming to Insurers Using AI

Among insurance customers, familiarity with AI is growing.

The number of customers in 2025 who are using an AI tool at least once a week has risen from 21% in 2024 to 33% in 2025, while those who have never used an AI tool has fallen from 40% to 28%.

Although the most regular users are younger, with 59% of 18-24 and 53% of 25–34-year-olds using AI on a weekly basis, 42% of those aged 35-44 are using it on a weekly basis too.

Increased use of AI has translated into greater comfort with insurers using it in some areas.

- The number of customers who are comfortable with insurers using AI to decide the price of an insurance policy without human intervention has increased from 31% in 2024 to 37% in 2025. Interestingly, there has been no real change amongst those that use AI once to a few times a week, going from 54% to 55%, but comfort amongst those that use AI everyday has increased from 68% in 2024 to 73%.

- When it comes to AI being used to process and settle a claim without human intervention, there has been a slight increase in comfort in 2025 (33%) versus 2024 (30%), but again the level of comfort is much higher amongst those that use AI every day (69%) and once to a few times a week (50%).

- Where there have been some more significant changes is in using AI to help a human call handler answer questions. While the overall picture shows only an increase in comfort from 41% to 44%, there have been more significant changes at a country level. In the UK, comfort has increased from 30% to 39% and in Spain it has gone from 44% to 51%.

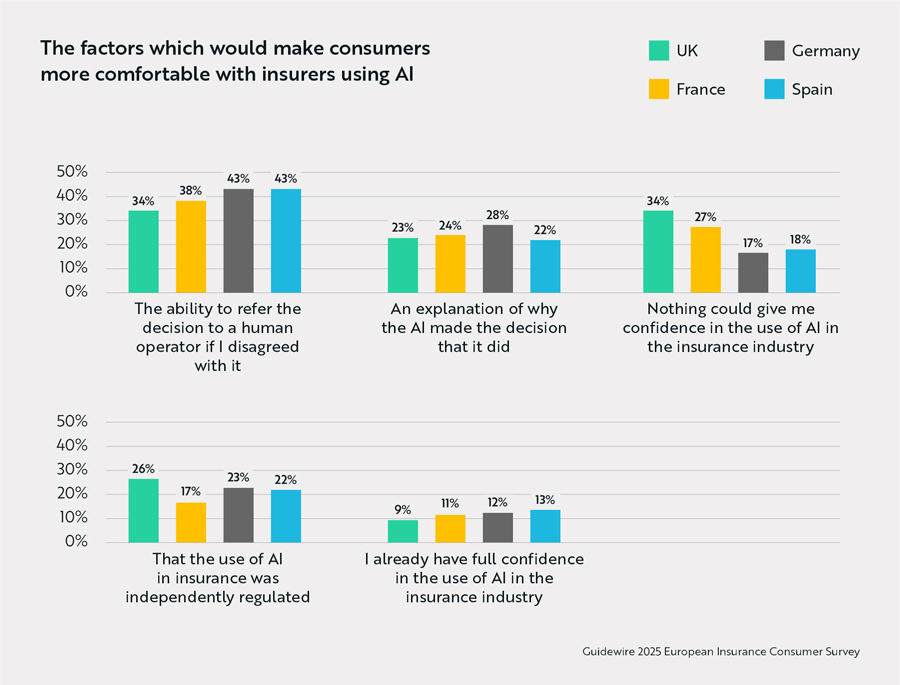

As customer comfort with insurers’ using AI grows, outright hostility to the use of AI may be slowly receding.

- The number who say that nothing could give them confidence in insurers using AI has also fallen, from 29% in 2024 to 24% in 2025.

- The UK is the most sceptical country (34%), although this has fallen from 41% last year.

- Interestingly, the greatest fall in people with a hostile opinion is in Germany, typically viewed as a market sceptical of technological innovation, going from 26% in 2024 to 17% in 2025.

As insurers who do not want to squander this opportunity and continue to get their customers onside with their greater use of AI, the report suggests:

- When looking at what would make people more confident in insurers' use of AI, the ability to refer an AI decision to a human operator if they disagree is still the principal factor (40%).

- The importance of an independent regulator is still low on people’s priorities (22%) and its significance has not changed in the last year.

Better customer familiarity with AI presents an opportunity for insurers to integrate AI into their services, particularly for younger customer segments. But insurers do need to be aware of how customers want a human in the loop and must build trust in their use of data for AI.

Greater Understanding of Climate Exposure

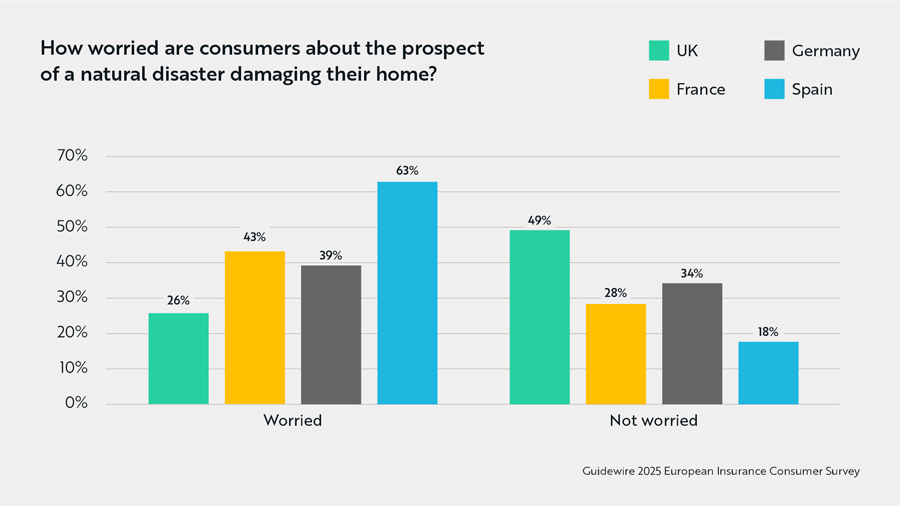

All the European markets we surveyed experienced serious incidents of extreme weather in the last 12 months so customers' responses are unsurprising.

When it comes to policyholder concerns about a natural disaster damaging their home, 43% say that they are worried about this happening.

- This is very variable across markets. Only 26% say that they are worried in the UK, while it is 39% in Germany, 43% in France and 63% in Spain.

- Overall, 38% say that they have considered purchasing insurance to cover damage from climate risks, with Spain (47%) and Germany (44%) being the most likely.

Policyholders say that the best way in which insurers could help them is to provide guidance on what they are covered for (32%). This is highest in Germany (28%), the UK (31%) and Spain (38%).

- There is also demand for insurers to provide a climate risk assessment tool (30%), with the greatest demand for this in Germany (28%) and France (34%). Simple explanations of weather-related insurance terms also rank highly (28%).

If they want to support their customers, insurers need to help customers quantify and understand the risks they face. In doing so, insurers can offer proactive support and new products that will make their policyholders more prepared for and resilient and improve the value insurers deliver to their customers.

Who Was Surveyed?

Guidewire commissioned Censuswide to survey 4,010 consumers, aged 18 and over, who have bought or renewed a general insurance product or made a claim under it in the last 12 months (1,000 per country – UK, France, Germany, and Spain). They were polled in March 2025. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

Previous studies:

2024: 4,126 consumers aged 18+ who have bought or renewed a general insurance product, or made a claim under it in the last 12 months across the UK, France, Germany, and Spain.

2023: 4,135 Insurance consumers aged 18+ who have bought or renewed a general insurance product, or made a claim under it in the last 12 months from the UK, France, Germany, Spain.

2022: 4,037 insurance consumers aged 18+ who have bought or renewed a general insurance product, or made a claim under it in the last 12 months in the UK, France, Germany and Spain.