In the rapidly evolving insurance landscape, cloud-based core systems and continuous innovation are significant competitive advantages. At Guidewire, we understand the importance of equipping insurers with new and innovative applications that seamlessly integrate into cloud-based core systems, providing greater capability and opportunity. To that end, we are proud to announce a significant milestone: the Guidewire Marketplace now hosts over 110 innovative cloud-based applications.

This achievement underscores our commitment to creating a robust ecosystem that meets the ever-changing needs of P&C insurers worldwide.

A Hub for Innovation

The Guidewire Marketplace acts as a centralized hub where insurers can access a variety of specialized and vetted insurtech and third-party applications, as well as Guidewire-built applications, designed to extend capabilities and functionality, promote innovation, enhance operational efficiency, and deliver tangible results. The Marketplace provides solutions for a wide variety of lines of business, including Commercial Auto, Commercial Property, General Liability, Homeowners, Personal Auto, Personal Property, and Workers' Compensation. It offers integrations for every core Guidewire system solution, including BillingCenter, ClaimCenter, InsuranceNow, and PolicyCenter, enhancing their functionality and operational capabilities.

Real-world results demonstrate that insurers can expedite innovation and reduce implementation times when leveraging Marketplace apps, enabling them to respond rapidly to market and risk changes while reducing costs and boosting customer satisfaction.

Strategic Partnerships with Purpose

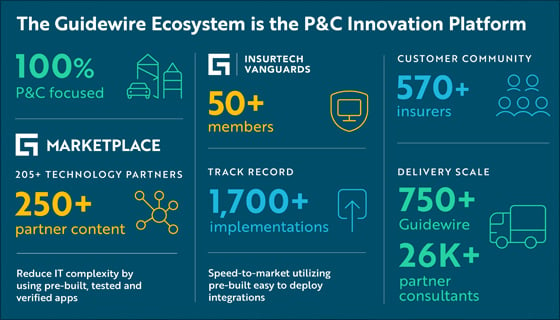

The success of the Guidewire Marketplace stems from our extensive network of strategic partnerships. With over 250 applications and integrations developed by more than 220 Technology partners, the Marketplace offers a diverse array of solutions tailored to meet the needs of insurers. Recently, contributions from consulting partners have been added to the Marketplace, including Guidewire-approved collections of prebuilt product model content that can be used to get products or lines of business launched faster on InsuranceSuite and InsuranceNow.

These partnerships and applications enhance the functionality and capabilities of insurers' core systems.

Applications include fraud detection solutions such as Shift's cloud accelerator for ClaimCenter, which leverages AI to identify suspicious claims effectively, and AI-driven technology from PhotoCert, which enables insurers to identify suspicious claims effectively. Advanced pricing solutions like Akur8’s use cutting-edge algorithms to enhance underwriting, while Smart Communications' SmartCOMM™ integration for PolicyCenter helps insurance companies create, manage, and deliver policyholder communications. The SmartCOMM integration plays a key role in enhancing customer experience and operational efficiency. Digital payment solutions like One Inc.'s integration for InsuranceNow further support insurers’ operational capabilities.

Every partner in the Guidewire Marketplace is carefully chosen for their ability to deliver measurable value.

Proven Impact

This impact is exemplified by the majority of Guidewire customers that leverage the Marketplace. For example, our collaboration with Definity, a forward-thinking insurer, involved integrating Smart Communications and Akur8 tools to transform claims processing and customer communication. With automated updates and responsive pricing models, Definity achieved a 30% reduction in claims processing times and a 20% increase in customer satisfaction. PhotoCert’s fraud detection further enhanced their efficiency, showcasing how pre-built integrations can drive substantial results.

Another success story comes from our work with a leading European insurer implementing Smartcom’s communications solutions. This integration enabled the insurer to provide real-time notifications and personalized updates to policyholders, transforming how they communicate with their customers. The result? Higher customer engagement, improved retention rates, and an enhanced brand reputation.

Such stories are a testament to the real-world benefits of the Guidewire Marketplace.

The Power of Innovation

The future of insurance is in the cloud. As insurers seek more agile and scalable solutions, cloud technology becomes essential for resilience and sustainable growth. Every new application in the Guidewire Marketplace is cloud-based, enabling insurers to deploy and scale seamlessly.

By leveraging the Guidewire Cloud Platform, our PartnerConnect Consulting and Technology partners can offer preconfigured solutions tailored to insurers’ specific use cases, providing them with the flexibility to innovate quickly. These solutions aren’t just about technology—they create a seamless experience that allows insurers to stay competitive and meet their customers’ evolving needs.

The cloud also plays a critical role in further reducing total cost of ownership (TCO). By eliminating the need for costly on-premises infrastructure, cloud-based solutions free up resources that insurers can reinvest into their business. Additionally, cloud solutions offer built-in security, automatic updates, and high availability, giving insurers confidence that their data is safe and systems are up-to-date.

The Guidewire platform is utilized by more than 570 P&C insurers across 42 countries to engage, innovate, and grow efficiently.

Looking Forward

Our achievements this year set a new standard for the Guidewire Marketplace, but we’re not stopping here. As we look ahead, we are focused on expanding the Marketplace to include even more global and regionally relevant solutions.

Recent partnerships with companies like Monoova in Australia and ICEYE in Europe demonstrate our commitment to meeting the specific demands of insurers worldwide. These regional partnerships bring local expertise and insights that enable insurers to address unique market challenges with precision.

The coming year will bring the introduction of more regionally focused content, along with new datasets and analytics tools aimed at enhancing insurers' decision-making capabilities. For example, the integration with ICEYE, a provider of satellite-based data and remote sensing solutions, gives Australian insurers access to real-time satellite data for natural disaster assessments. This enables insurers to manage claims more effectively and provide crucial support to policyholders during critical events.

With plans to introduce more cloud-native applications and data-driven tools, the Guidewire Marketplace will continue to offer flexible, scalable, and innovative solutions to meet the evolving demands of the industry. Learn more about the products and services available on the Marketplace: www.marketplace.guidewire.com.

Understanding Guidewire’s Ecosystem

Guidewire Ecosystem: A comprehensive network of technologies, services, and partnerships that enhance Guidewire's platform for P&C insurers, encompassing core solutions, partner integrations, data analytics, and consulting. (Watch video overview)

Guidewire PartnerConnect: A key ecosystem component, the PartnerConnect network comprises Consulting and Technology partners who provide expertise and complementary solutions that align with Guidewire’s core systems.

Guidewire Marketplace: The central hub for innovation, featuring pre-built apps and integrations that extend the functionality of Guidewire products, allowing insurers to enhance operations and capabilities without extensive development.

Insurtech Vanguards Program: This initiative identifies and collaborates with innovative insurtech startups to bring fresh solutions to the industry, supported by Guidewire’s strategic guidance and customer access.