As the winter season gets underway, cold-weather risks are dancing in the minds of insurers and homeowners alike. Last year, winter storms resulted in approximately $3.4 billion in insured losses in the U.S. The year before, that figure was $6 billion.

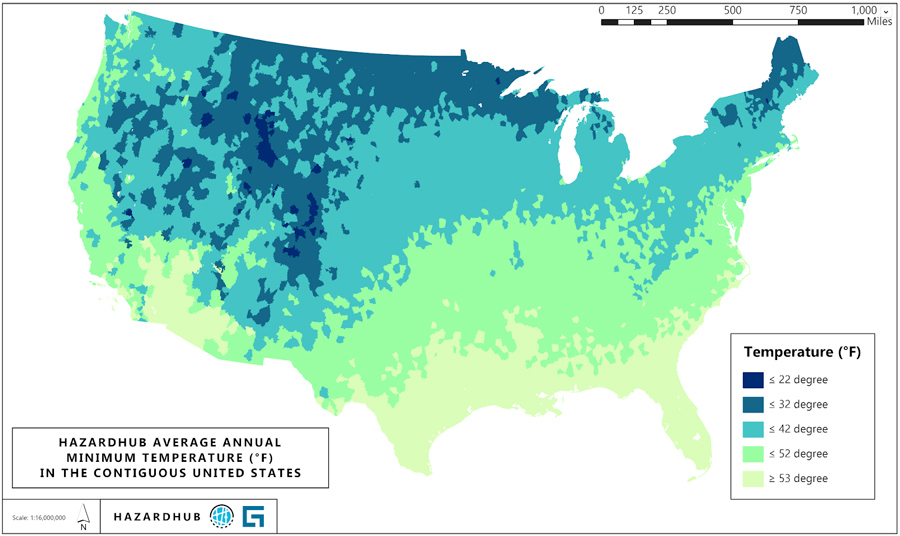

According to Guidewire HazardHub data, 31.4 million housing units in the U.S. will experience more than 30 days of winter temperatures below 32ºF this year. Of those, more than 10.3 million housing units will experience more than 50 days of below-freezing temperatures this winter.

HazardHub provides risk data and maps detailing extreme cold and winter weather risks at national, state, and local levels — right down to specific property addresses. According to an analysis of HazardHub data, the most perilous winter weather risks, based on potential claims loss, extent of damage, and frequency, are:

- Frozen pipes should be top of mind when preparing for cold weather. Freezing temperatures cause water inside pipes to expand, leading to cracks and bursts that result in extensive water damage to flooring, drywall, and home contents. This peril is one of the most frequent and costly winter insurance claims. Homeowners can mitigate this risk by insulating pipes, maintaining indoor heat, allowing faucets to drip during cold snaps, and draining water lines in vacant properties. According to HazardHub data, 21% of homes in the U.S. are at risk of frozen pipes each winter, with the average frozen pipe claim costing approximately $18,000. Water damage and freezing incidents account for nearly 24% of all homeowners insurance claims.

- Snow load is another significant risk, particularly in states like Alaska, Maine, and Vermont, where heavy snowfall accumulates on roofs. The weight of snow and ice can place considerable stress on roofs, leading to structural damage or collapse, especially for older buildings or those with flat roofs. HazardHub data shows that 36% of homes in Maine, 35% in Vermont, and 28% in New Hampshire are at risk for snow load damage. Homeowners can reduce this risk by regularly clearing snow from their roofs, maintaining gutters, and trimming overhanging branches.

- Ice dams form when heat escapes through poorly insulated roofs, melting snow that then refreezes at the roof's edge. These ice blockages prevent proper drainage, causing leaks, roof damage, and water infiltration inside the home. HazardHub data indicates that 28.4% of U.S. census blocks experience more than 30 days of freezing temperatures annually, affecting around 31.4 million homes. Insurance claims due to water damage caused by ice dams average around $11,100. Whereas, preventative ice dam removal costs between $400 to $4,000, depending on the size and location of the dam. Preventive measures are substantially less expensive than the average ice dam-related water damage costs. Other preventative measures include insulating attics, installing heat cables along roof edges, and regularly clearing snow.

- Power outages in winter can be caused by fallen trees, heavy snow, and ice damaging or toppling power lines. These outages can disrupt heating, refrigeration, and business operations. Prolonged outages can lead to property losses including frozen pipes and food spoilage, and potential loss of use claims. Over the past two decades, 80% of major U.S. power outages were weather-related, with winter storms responsible for 23% of them. Investing in backup generators, stocking emergency supplies, and trimming trees near power lines can help mitigate these risks.

- Wind damage is a frequent companion of winter storms. High winds can tear shingles off roofs, topple trees onto structures, and cause significant property damage. These incidents often lead to secondary problems, such as water infiltration. Blizzards and major winter storms are characterized by sustained winds exceeding 35 miles per hour and, in some cases, gusts surpassing 50 miles per hour. Homeowners in wind-prone regions should reinforce roofs, secure outdoor items, and maintain their trees to reduce the risk of damage.

- Flooding from snowmelt presents another challenge when winter comes to an end and Spring begins to blossom. Rapid snowmelt, particularly during seasonal temperature swings, can overwhelm drainage systems, causing basement flooding and foundation damage. This risk is especially high in areas that experience heavy snowfall followed by sudden warming. Flood damage is typically not covered by standard homeowners policies and requires separate flood insurance. The U.S. Geological Survey reports that flood losses, across all seasons, average $8 billion annually. Ensuring proper drainage around foundations and installing sump pumps can help mitigate this risk.

- Finally, house fires caused by heating sources are a significant winter threat.According to the U.S. Fire Administration (USFA), approximately 100,000 winter residential building fires occur in December, January, and February, resulting in approximately $1.9 billion in property damage or loss each year. The increased use of space heaters, fireplaces, and wood stoves during colder months raises the risk of fires, particularly in vacant properties. Improper use of heating equipment, overloaded circuits, and unclean chimneys are common culprits. Homeowners can reducehouse fire risk this winter by keeping flammable materials away from heat sources, using space heaters responsibly, and maintaining fireplaces and chimneys regularly.

More data and maps of winter weather risks are available in our recently released press release.

HazardHub's detailed winter risk data and maps are available through Guidewire’s PolicyCenter and InsuranceNow solutions, as well as via the HazardHub API. Insurers can utilize this data to enhance risk assessment and underwriting accuracy, while property owners can better prepare for winter’s challenges. Consumers interested in assessing their home’s winter risks can visit freehomerisk.com.