Covid-19 is forcing our industry to rethink how insurers do business with their consumers. In this blog series, I will focus on insurtechs in our partner community that are enabling the “new normal” of digital and online business.

1 in 30 claims are fraudulent.

With much of the country on lockdown or practicing social distancing measures to flatten the curve of the COVID-19 pandemic, there is an uptick in insurance fraud cases according to the FBI. Insurance fraud is a multibillion-dollar criminal enterprise that often preys on consumer’ fears and anxieties during times of crisis. Social Discovery is a data analysis company that provides social media background screening and investigative reporting services. When integrated with Guidewire, the company empowers adjusters to become fraud fighting superheroes.

Who?

Social Discovery combines machine learning with human “moderation” to provide investigative social media background reporting services. Unlike other investigative services, Social Discovery differentiates themselves through their laser focus on social media investigation and not providing other services like surveillance.

“The use of curated social media reports at intake at the claims level has been shown to drive claims validation as well as provide fraud indicators early on. We believe strongly that claims VP's are very concerned about performance, throughput, efficiency and customer satisfaction - all of which can be garnered from early deployment which our partnership helps to facilitate,” said Allan Stark, CEO, Social Discovery Corp.

The value proposition

Social Discovery collects and searches data from social networks like Twitter, Facebook, TikTok, and Strava as well as from the Internet. With some human moderation of the data, they provide insurers with a report of their findings. This meta data is collected in a legally defensible way meaning that it can be used in subrogation, mediation, or other litigation events.

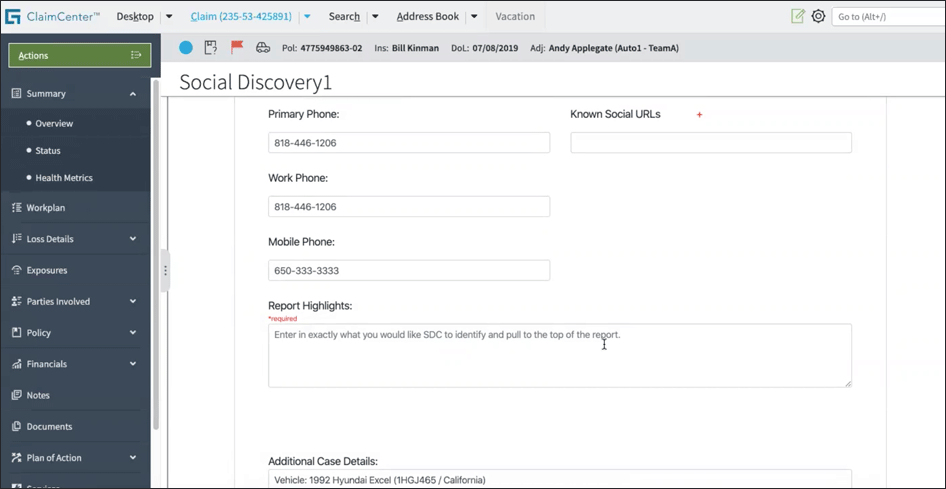

Integrated with ClaimCenter, adjusters have one-click access to the Social Media reports within Social Discovery’s solution. The adjuster can manually request a report or based on automated rules processing, ClaimCenter can automatically order the reports when certain claim events are triggered.

There is no need for the adjuster to flip back and forth between systems because all necessary information contained in the claim file will auto populate the report request. The adjuster can also provide commentary on what they would like the investigation to focus on in the Report Highlights box.

The reports flow right back into the individual claim file for easy reference.

The information Social Discovery gathers is readily available in the public domain. The insurer does not need permission from the person being investigated to allow them to see what is publicly available.

The opportunity

Social Discovery has more than 15 common customers, three of which are in the process of integrating Social Discovery with ClaimCenter.

“When times are tough people are always looking for new ways to make ends meet,” shares FRISS CEO and Co-founder Jeroen Morrenhof, who’s company FRISS – a Guidewire partner - has been fighting fraud for insurance carriers since 2006. “We saw this during the 2008 recession, and insurance is unfortunately often seen as a victimless crime and an easy way to make a quick return. While we hear all sorts of stories that claims are going down during this pandemic, unfortunately we see first-hand a sharp increase in suspicious claims.”

In the words of Diana Prince a.k.a. Wonder Woman, “Fight for those who cannot fight for themselves.” Guidewire partnered with Social Discovery to provide adjusters with the superpowers they need to fight for the innocent, you and me who pay for the price of fraud every year in the form of increased premiums.

Want more detail?

Click on the image below to read the Social Discovery blog postings.