Who?

Predictive fraud analytics for property and casualty insurance.

What do you need to know?

I had the opportunity to speak with the CEO of FRISS, Jeroen Morrenhof, who described the three main use cases FRISS supports:

FNOL Fraud Detection – detects fraud during creation of the claim. For example, a staged loss or similar previous claim.

Referred to the Special Investigative Unit (SIU) – FRISS provides case management tools which allow the SIU team to assess alerts and manage the claims until its closure.

Underwriting – fraud can be prevented by feeding back into underwriting claim history based on inputs like driver’s license.

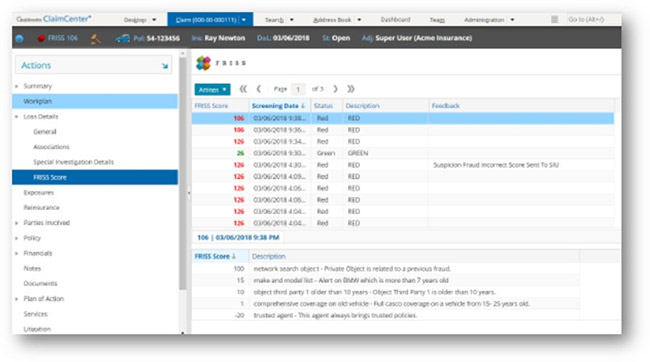

The real-time FRISS score is at the core of the solution. It indicates the level of risk for each policy or claim.

Why do you need to know this?

FRISS joined the Guidewire PartnerConnect™ program in May 2018 as a Solution partner and its Fraud Detection at Claims accelerator integrates with ClaimCenter.

The FRISS score displays within the claim file and includes details about indicator hits. Based on FRISS results, activities can be generated, and payments as well as reserves can be blocked.

Jeroen will be participating in the Connections 2018 InsurTech panel discussion, “InsurTech Panel Pitch – What’s New for the Digital Carrier”, taking place on Tuesday, October 16th at 4:45 p.m. in Margaux #2.