Typically, I’d avoid relying on overused proverbs, but I think this one is appropriate. At Guidewire, we have a long journey ahead of us to build more complete local content for Australian and New Zealand insurance. Maybe it will be a never-ending journey, but we’ve now taken a significant first step that demonstrates our commitment to getting the job done.

First, let’s talk about that commitment.

Guidewire has invested significantly in developing market-specific content. A sizeable team dedicated to the ANZ region includes software engineering, program management, product management, and business analysis. But this is only half the commitment. The other half is to listen to and collaborate with our customers — both present and future — to ensure that our direction remains aligned with their needs.

Now back to that first step.

With our Elysian release of Guidewire Cloud Platform, we’ve introduced our first iteration of ANZ regional content. Many customers will already have seen the developer access versions of the products, and we’ve now made minor improvements on the way to general availability. The release covers three themes:

-

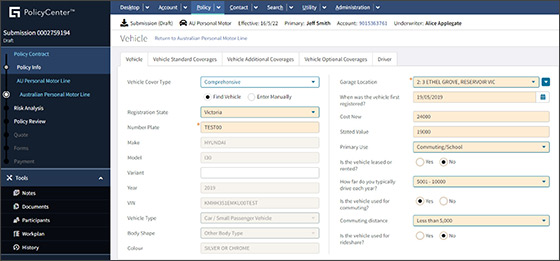

Line-of-business content: Insurers can create a quick-start Australian personal motor line. The quick-start policy has typical coverages, aligning with Comprehensive, Fire and Theft, and Third-Party Property Damage products. The claims solution supports policy search and retrieval and management of claims against the policy. The included Advanced Product Designer mind map and template enable customers to further adapt the line to their needs.

-

Regulatory, standards, and tax content: We’ve implemented Australian Goods and Services Tax in Elysian to support claim payments. This includes tax registration on accounts and policies in the policy administration suite, PolicyCenter as well as calculations for IAM and DAM on claim payments in the claim management center, ClaimCenter. The calculations are implemented for acquisitions and settlements for insured and third parties.

-

Market integrations: The Elysian release enables local service providers for two key integrations — address and vehicle. Address integration provides PolicyCenter and ClaimCenter clients for data that is sourced from the postal address file and geocoded national address file. Vehicle integration enables a PolicyCenter client to retrieve NEVDIS-sourced data using a state and number plate. Both integrations have local service-provider implementations to support end-to-end demonstrations. Talk to us about enabling your service provider.

One step does not make a journey; we need to keep walking.

Our immediate plan is to iteratively improve the first release by adding line-of-business REST APIs for Australian personal motor in PolicyCenter, aligning with local expectations for excess and limit handling in ClaimCenter, extending address lookup for contact creation in ContactManager, and integrating with the Australian Business Register to look up businesses using ABN, ACN, or business names.

With our eyes continuously focused on the future, we’re already planning for subsequent steps such as embedding support for the General Insurance Code of Practice in Claims and Policy workflows (mentioned in our April blog post) and investigating local content for New Zealand.

Any journey is better with good companionship. So join us and share your thoughts and feedback.